Rate pause fails to cheer mkts

Profit booking halts 4-day rally; Investors pare exposure to auto, bank and IT stocks as marginal downward revision on inflation signals cautious approach

image for illustrative purpose

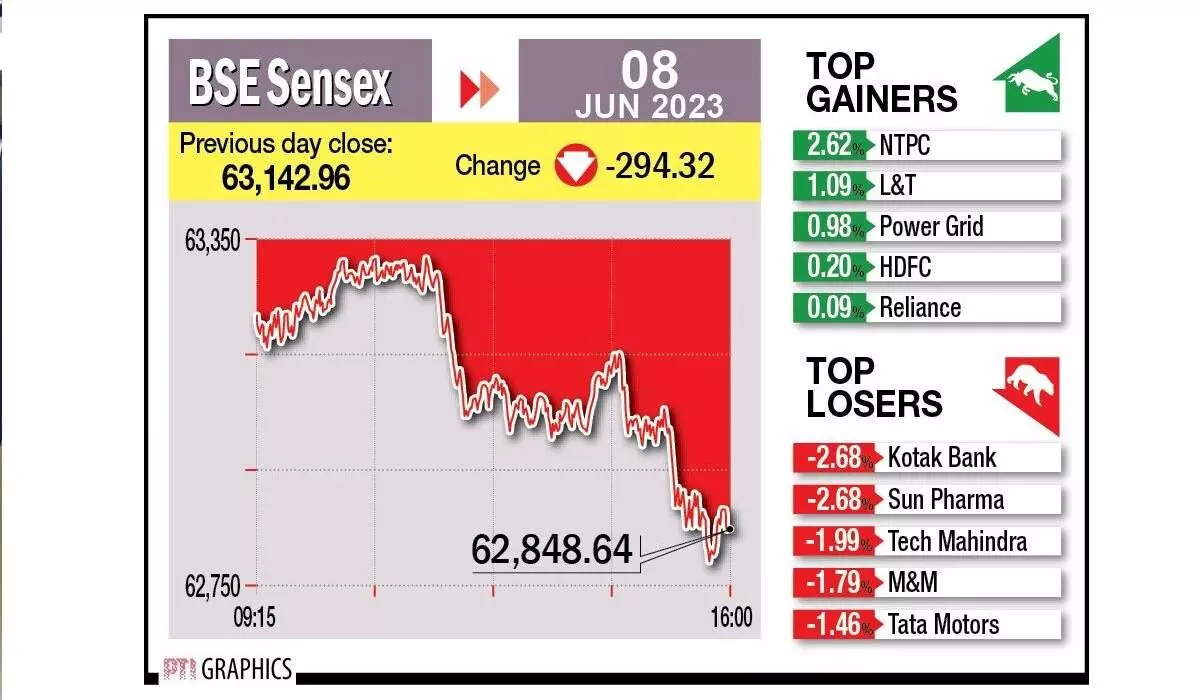

Mumbai Equity benchmarks Sensex and Nifty surrendered early gains to close with losses on Thursday, snapping their four-day winning streak as investors paredexposure to auto, bank and IT stocks after the RBI left its key interest rate unchanged.

After remaining in the positive territory for most of the session, the 30-share BSE Sensex fell 294.32 points or 0.47 per cent to settle at 62,848.64. During the day, it tumbled 353.23 points or 0.55 per cent to 62,789.73. The NSE Nifty declined 91.85 points or 0.49 per cent to end at 18,634.55.

“Investor sentiment took a downturn following the in-line monetary policy announcement by the RBI, as the market had higher expectations for a more optimistic revision in the inflation outlook, taking into account the recent easing of inflation data. The RBI’s decision to lower the inflation rate by only 10 bps suggests a cautious stance due to geo-political uncertainties, the potential impact of El Nino and the increase in Minimum Support Price,” said Vinod Nair, head (research) at Geojit Financial Services.

“Indian equities witnessed profit booking on the day of the RBI policy meeting outcome, which was on expected lines post the RBI policy outcome; the markets saw some profit booking in the interest rate-sensitive sectors, which dragged the indices down. Except for Metals, all sectors ended in red,” said Siddhartha Khemka, head (retail research), at Motilal Oswal Financial Services.

“Global markets were mixed on Thursday as negative sentiments arising out of expectations of further interest rate hikes by major central banks and the fact that Eurozone has entered recession after its Janaury-Mar GDP fell 0.1 per cent was offset by optimism over more Chinese stimulus measures,” said Deepak Jasani, head (retail research), HDFC Securities.

“Sharp correction in the last hour trade pulled down the Sensex below the 63,000 mark, as realty shares faltered sharply after the recent upsurge. While the rate hike pause by the MPC was on expected lines, subdued commentary by the RBI on inflation for this fiscal year dampened the sentiment,” said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities Ltd.

Dhiraj Relli, MD and CEO, HDFC Securities, said: “The RBI MPC left the Repo rates unchanged at its meeting on June 8 in line with street expectations. MPC members were in a sweet spot in the backdrop of higher than expected GDP numbers and moderating headline and core inflation print.”

Foreign Institutional Investors (FIIs) bought equities worth Rs 1,382.57 crore on Wednesday, according to exchange data.

Among the indices, realty tumbled by 1.51 per cent, telecommunication (1.06 per cent), auto (0.97 per cent), IT (0.88 per cent), FMCG (0.81 per cent), bankex (0.80 per cent), consumer discretionary (0.76 per cent) and commodities (0.66 per cent). Industrials, utilities, capital goods and power were the gainers.